Main Publications

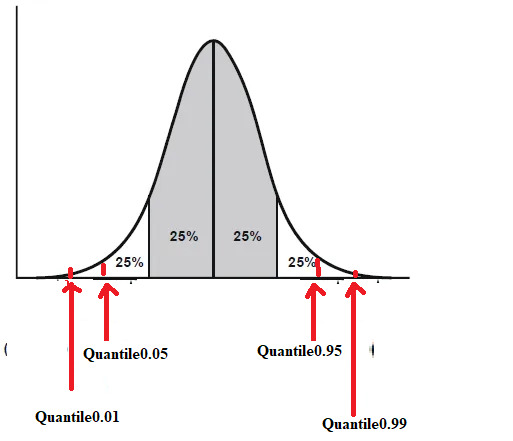

This paper develops a dynamic model of rational behavior under uncertainty, in which the agent maximizes the stream of future τ-quantile utilities, for τ ∈ (0 1). That

is, the agent has a quantile utility preference instead of the standard expected utility. Quantile preferences have useful advantages, including the ability to capture hetero-

geneity and allowing the separation between risk aversion and elasticity of intertemporal substitution. Although quantiles do not share some of the helpful properties of expectations, such as linearity and the law of iterated expectations, we are able to establish all the standard results in dynamic models. Namely, we show that the quantile preferences are dynamically consistent, the corresponding dynamic problem yields a value function, via a fixed point argument, this value function is concave and differentiable, and the principle of optimality holds. Additionally, we derive the corresponding Euler equation, which is well suited for using well-known quantile regression methods for estimating and testing the economic model. In this way, the parameters of the model can be interpreted as structural objects. Therefore, the proposed methods provide microeconomic foundations for quantile regression methods. To illustrate the developments, we construct an intertemporal consumption model and estimate the discount factor and elasticity of intertemporal substitution parameters across the quantiles. The results provide evidence of heterogeneity in these parameters.

We consider estimation of finite-dimensional parameters identified by general conditional quantile restrictions, including instrumental variables quantile regression. Within a generalized method of moments framework, moment functions are smoothed to aid both computation and precision. Consistency and asymptotic normality are established under weaker assumptions than previously seen in the literature, allowing dependent data and nonlinear structural models. Simulations illustrate the finite-sample properties. An in-depth empirical application estimates the consumption Euler equation derived from quantile utility maximization. Advantages of quantile Euler equations include robustness to fat tails, decoupling risk attitude from the elasticity of intertemporal substitution, and error-free log-linearization.

A fundamental result of modern economics is the conflict between efficiency and incentive compatibility, that is, the fact that some Pareto optimal (efficient) allocations are not incentive compatible. This conflict has generated a huge literature, which almost always assumes that individuals are expected utility maximizers. What happens if they have other kind of preferences? Is there any preference where this conflict does not exist? Can we characterize those preferences? We show that in an economy where individuals have complete, transitive, continuous and monotonic preferences, every efficient allocation is incentive compatible if and only if individuals have maximin preferences.

This paper proposes a new general class of strategic games and develops an associated new existence result for pure-strategy Nash equilibrium. For a two-player game with scalar and compact action sets, existence entails that one reaction curve be increasing and continuous and the other quasi-increasing (i.e., not have any downward jumps). The latter property amounts to strategic quasi-complementarities. The paper provides a number of ancillary results of independent interest, including sufficient conditions for a quasi-increasing argmax (or non-monotone comparative statics), and new sufficient conditions for uniqueness of fixed points. For maximal accessibility of the results, the main results are presented in a Euclidean setting. We argue that all these results have broad and elementary applicability by providing simple illustrations

with commonly used models in economic dynamics and industrial organization.

This paper reconsiders the well-known comparison of equilibrium entry levels into a Cournot industry under free entry, second best (control of entry but not production) and first best (control of entry and production). Allowing for the possibility of limited increasing returns to scale in production, this paper generalizes the conclusion of Mankiw and Whinston (1986) [10], that under business-stealing competition, free entry yields more firms than the second-best solution. We also show that under-entry always holds under business-enhancing competition. This confirms the general intuition given by Mankiw and Whinston, which does not rely on the convexity of the cost function. The same result is shown to extend (at a similar level of generality) to the comparison between free entry and the first best socially optimal solution, irrespective of business-stealing. Three illustrative examples are provided, one showing that the second-best and free entry solutions may actually coincide.

A preference is invariant with respect to a set of transformations if the ranking of acts is unaffected by reshuffling the states under these transformations. For example, transformations may correspond to the set of finite permutations, or the shift in a dynamic choice model. Our main result is that any invariant preference must be parametric: there is a unique sufficient set of parameters such that the preference ranks acts according to their expected utility given the parameters. Parameters are characterized in terms of objective frequencies, and can thus be interpreted as objective probabilities. By contrast, uncertainty about parameters is subjective. The preferences for which the above results hold are only required to be reflexive, transitive, monotone, continuous, and mixture linear.

We prove the existence of monotonic pure strategy equilibrium for many kinds of asymmetric auctions with n bidders and unitary demands, interdependent values and independent types. The assumptions require monotonicity only in the own bidder’s type. The payments can be a function of all bids. Thus, we provide a new equilibrium existence result for asymmetrical double auctions and a small number of bidders. The generality of our setting requires the use of special tie-breaking rules. We present an example of a double auction with interdependent values where all equilibria are trivial, that is, they have zero probability of trade. This is related to Akerlof’s “market for lemmons” example and to the “winner’s curse,” establishing a connection between them. However, we are able to provide sufficient conditions for non-trivial equilibrium existence.

News (mostly in Portuguese)

Jornal Pequeno (5 de julho de 2021) — Gasto por parlamentar no Brasil é 528 vezes maior que a renda média da população, diz estudo

Jornal Pequeno / Blog do John Cutrim 5 de julho de 2021 O Brasil tem a maior despesa por parlamentar quando comparado à renda média do país, é a nação que mais gasta com financiamento público de partidos políticos e é o que tem o maior número de agremiações partidárias. As constatações fazem parte de […]

Read more

O Globo — (5 de julho de 2021) — Gasto por parlamentar no Brasil é 528 vezes maior que a renda média da população, diz estudo

A Caixa Geral de Depósitos que hoje conhecemos é o culminar de uma evolução que se iniciou muito antes da sua fundação em abril de 1876.

Read moreO Globo – Editorial (11 de julho de 2021) — Custo absurdo põe Congresso brasileiro entre os mais caros

Editorial de O Globo, July 11th, 2021 https://blogs.oglobo.globo.com/opiniao/post/custo-absurdo-poe-congresso-brasileiro-entre-os-mais-caros.html

Read moreBand News (5 de julho de 2021) — Brasil é o país com maior gasto por parlamentar no mundo

Read moreRadio BandNews (12 de julho de 2021) – Custo absurdo põe Congresso brasileiro entre os mais caros, diz IMPA

https://drive.google.com/drive/folders/1hf7ta9NOyVb4YDXZFGtH2ZAlRKjZwT5T?usp=sharing

Read moreJornal da Cultura (July 5, 2021) — Parlamentar custa 528 vezes a renda média no país

Read moreJornal da Record (6 de julho de 2021) — Estudo revela que cada parlamentar brasileiro custa mais de R$ 20 milhões por ano aos cofres públicos

https://m.facebook.com/watch/?v=999095307499008&paipv=0&eav=Afbr0NTSUQG0_YvnRle1Vb28cRHky4u8564M_YdZIg-RqiAnGG5NyHUslsp8fkwD0FI&_rdr

Read moreJornal do Comercio (7 de julho de 2021) – Cada parlamentar custa mais de 500 vezes a renda média de um brasileiro; por que isso acontece?

https://noticias.r7.com/jr-na-tv/videos/estudo-revela-que-cada-parlamentar-brasileiro-custa-mais-de-r-20-milhoes-por-ano-aos-cofres-publicos-06062022

Read moreWorking papers

Affiliation was introduced by Milgrom and Weber (1982) through the positive dependence intuition, that is, high value of one bidder’s estimate makes high values of the others’ estimates more likely. However, positive dependence has many alternative definitions; we show that affiliation is one of the most restrictive among them. This poses the question whether affiliation’s main implications (equilibrium existence and the revenue ranking of auctions) remain valid for other formalizations of positive dependence. We show that both implications can indeed be generalized in the context of private values, and give counterexamples for further generalizations.

Most developing economies rely on foreign capital to finance their infrastructure needs. These projects are usually structured as long-term (25-35 year) franchises that pay in local currency. If investors evaluate their returns in terms of foreign currency, exchange rate volatility introduces risk that may reduce the level of investment below what would be socially optimal. In this paper, we propose a mechanism with very general features that hedges exchange rate fluctuation by adjusting the concession period. Such mechanism does not imply additional costs to the government and could be offered as a zero-cost option to lenders and investors exposed to currency fluctuations. We illustrate the general mechanism with three alternative specifications and use data from a 25-year highway franchise to simulate how they would play out in eight different countries that exhibit diverse exchange rate trajectories.

GOOGLE SCHOLAR'S WEBPAGE

GOOGLE SCHOLAR'S WEBPAGE

PDF

PDF

Presentation (in PT-BR)

Presentation (in PT-BR)